How to Build A Statistical Framework On A Method

Forecasting with exponential smoothing is a book focused on a niche topic. I

picked up this book because I like Rob Hyman's other papers and books. There is

also another familiar name, Keith Ord, who wrote a fantastic practical book on

business forecasting. If you are interested in this book, check out my

video review.

Exponential smoothing was formulated without a statistical

framework. It has been a successful forecasting algorithm and practice for

decades.

Why fuse about the lack of statistical framework in the back end? The

authors expound on the utility of having a statistical framework for

exponential smoothing. I think that if you are interested in writing forecasting

software, teaching exponential smoothing, or getting a deeper understanding of

forecasting methodology, this is the book for you. But I think there is more to

this book than just being a passive observer of the unfolding of a statistical

framework. I think this book is an example of how good forecasters think

critically. If you pay attention, you may walk away with some thoughts on how to

add statistical frameworks to other algorithms.

One thing I appreciated was

the recursive calculation tables. It was nice to be able to compare and contrast

models with different trend and seasonality parameters and how to factor in

errors that were additive or multiplicative. Then I could compare

state space tables against the recursive formulas to see what the authors were

bringing to the table. I like this section on MASE, which is mean absolute

scaled error. It is clear that this is an important metric for modern

forecasting, sections and with exercises.

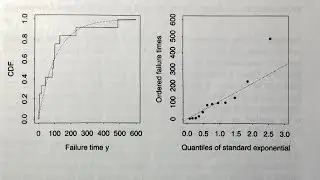

When you set exponential smoothing on a

statistical framework, you get prediction distributions for free. Authors

dedicate a full chapter on how these prediction distributions are generated.

One topic that is sometimes glossed over is how to handle time series with

multiple seasonal patterns. They offer some advice for practitioners on how to

approach this problem within the scope of exponential smoothing.

I really enjoyed

their section on count data. It is a common problem in firms but rarely

addressed in books and literature. One thing I really appreciated was the table

they had comparing forecast performance of various models. I learned how to

compare models a little better from this table alone. First, they used MASE as a

metric. Second, they compared many models. Third, they reported the mean, median

and standard deviation. Fourth, they had a benchmark performance of a model they

called Z. Z was simply predicting zero always. Those performance was not good. It

was nice to have a sense of what kind of error a simple assumption like that would

work out to be. Part four is the section I have revisited the most. It is hard for

practitioners to really know what other forecasters are doing in other

companies. Most work is considered IP. That makes sense and I also respect that as

well. Because ideas are not always shared completely across firms, the

applications, sections and books are sometimes the best tutor you can have for

real business scenarios. Thanks for watching and we'll see you next time.

XVZFTUBE ONLINE:

🕸️ https://xvzf.bearblog.dev/tools/

📁 GitHub: https://github.com/xvzftube

FREE AND OPEN SOURCE SOFTWARE THAT I CURRENTLY USE:

📽️ FFmpeg|LGPL: ............. https://ffmpeg.org/

🎵 Audacity|GPL: ............ https://www.audacityteam.org/

🗒️ Neovim|Apache 2.0: ....... https://neovim.io/

R R|MIT: ................... https://www.r-project.org/

🐍 Python|Python: ........... https://www.python.org/

🪶 SQLite|Public Domain: .... https://www.sqlite.org/index.html

🦆 DuckDB|MIT: .............. https://duckdb.org/

🍥 Debian|GPL: .............. https://www.debian.org/

![Lightning-Fast Setup: Get VS Code & Python Up and Running in No Time [Windows | 2023]!](https://images.mixrolikus.cc/video/EdxAUXXGB_M)