Income tax slabs FY 2023-24 & AY 2024-25 calculation with new tax regime and old tax regime.

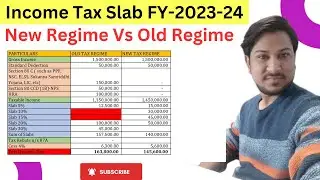

Income tax slabs FY-2023-24 New Tax Regime vs Old Tax Regime.

In this video, we learn how to calculate income tax with new tax regime and old tax regime with example for FY-2023-24 & AY 2024-25.

We will also see investment options available in old and new tax regimes along with which tax regime is better for you in hindi. Income tax slabs 2023-24 kya hai.

Income Tax Slabs 2023-24 with Calculations | New vs Old Tax Regime.

Old Tax Regime Slab Rates 2023-24:

Rs. 0 – Rs. 2.5 Lakh 0%

Rs. 2.5 Lakh – Rs. 5 Lakh 5%

Rs. 5 Lakh – Rs. 10 Lakh 20%

Rs. 10 Lakh or above 30%

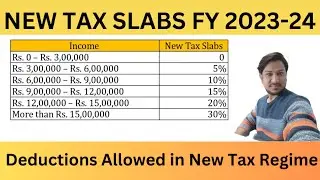

New Tax Regime Slab Rates 2023-24:

Rs. 0 – Rs. 3 Lakh 0%

Rs. 3 Lakh – Rs. 6 Lakh 5%

Rs. 6 Lakh – Rs. 9 Lakh 10%

Rs. 9 Lakh – Rs. 12 Lakh 15%

Rs. 12 Lakh – Rs. 15 Lakh 20%

Rs. 15 Lakh or above 30%

Notes: - New Tax Regime will be default tax regime from FY 2023-24.

Income Tax Slabs 2023-24

Old Tax Regime Slab rates

New Tax Regime Slab rates

Tax Rebate 87A limits

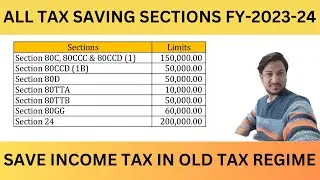

Investment options to Save Income Tax

Deductions in new tax regime

Income Tax Calculation Examples

You also have to option to choose old tax regime - Standard Deduction of Rs. 50,000 will be available with new tax regime - Tax rebate with new tax slabs 2023-24 will be Rs. 7 lakh instead of Rs. 5 lakh - Tax exemption limit with new tax regime is Rs. 3 lakh instead of Rs. 2.5 Lakh

DEDUCTIONS AND EXEMPTIONS AVAILABLE IN NEW TAX REGIME –

Standard Deduction of Rs. 50,000 is available under New Tax Regime from FY 2023-24

Transport allowance can be claimed in case of specially-abled person - Conveyance allowance for employees received to meet conveyance expenditures

Compensation received for cost of travel or tour

Daily Allowance received as compensation for cost of living in some other place compared to regular place of working

Deduction for employer’s contribution in NPS Account under Section 80CCD(2)

Home Loan Interest amount under Section 24 in case of let-out property

Deduction of amount paid or deposited in Agniveer Corpus Fund under Section 80CCH(2)

Gifts up to Rs. 5000

Exemption on voluntary retirement 10(10C), gratuity u/s 10(10) and Leave encashment u/s 10(10AA)

If you want learn about What is GST, How to file GSTR-1.

Please click on given link below:-

GST Course #1 What is GSTR-1, GSTR-2, GSTR-3B,ITC In detail | GST basic to advance sikhe

PART-1 LINK:- • Free GST Complete Course in Hindi|Wha...

Tally Features in GST| GST basic to advance course

PART-2 LINK:- • GST basic to advance course Part-2|| ...

Create sales voucher with multiple Tax rate

PART-3 LINK:- • Tally Prime- Purchase Entry With GST ...

Create Sales Invoice with Multiple GST rate

PART-4 LINK:- • Part-4, Create Sales Invoice with Mul...

GSTR 1 Return Filing online-2023

PART-5 LINK • How to File GSTR 1| GSTR 1 Return Fil...

Income tax slabs FY 2023-24 & AY 2024-25 calculation with new tax regime and old tax regime.

• Income tax slabs FY 2023-24 & AY 2024...

New Tax Slabs FY 2023-24 & AY-2024-25|Deductions Allowed in New Tax Regime|New Tax Regime Exemption.

• Deductions Allowed in New Tax Regime|...

![[FREE] ЛИРИЧНЫЙ БИТ ДЛЯ РЭПА 2023 ФРИСТАЙЛ БИТ](https://images.mixrolikus.cc/video/RcuUVj1sTkU)

![[Doesn'tWork] ДОСТУП К BROFIST.IO 2 В 2020 ГОДУ?! | АБСОЛЮТНО БЕСПЛАТНО](https://images.mixrolikus.cc/video/uOMx5R8engg)