Deductions Allowed in New Tax Regime|New Tax Slabs FY 2023-24 & AY-2024-25|New Tax Regime Exemption.

New Tax Slabs FY 2023-24| Deductions Allowed in New Tax Regime| New Tax Regime Exemption FY-2023-24.

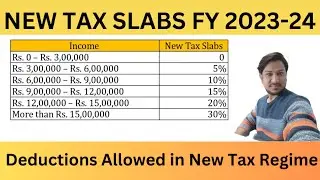

New Tax Slabs 2023-24 & AY 2024-25

Budget 2023 Changes

New Tax Slabs for FY 2023-24 & AY 2024-25

Old Tax Slabs for FY 2023-24 & AY 2024-25

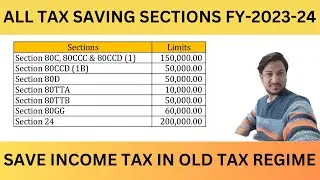

Deductions allowed in New Tax Regime

New Tax Slabs 2023-24 Conclusion

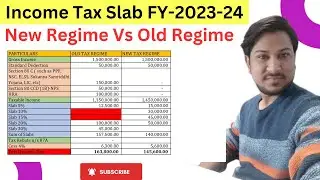

new tax regime vs old tax regime

Below are some key points about new tax slabs 2023-24.

New Tax Regime will be default tax regime from FY 2023-24.

You also have to option to choose old tax regime

Standard Deduction of Rs. 50,000 will be available with new tax regime

Tax rebate with new tax slabs 2023-24 will be Rs. 7 lakh instead of Rs. 5 lakh

Tax exemption limit with new tax regime is Rs. 3 lakh instead of Rs. 2.5 Lakh

Below are the new tax slabs for 2023-24 for all age groups:

Rs. 0 – Rs. 3,00,000 0%

Rs. 3,00,000 – Rs. 6,00,000 5%

Rs. 6,00,000 – Rs. 9,00,000 10%

Rs. 9,00,000 – Rs. 12,00,000 15%

Rs. 12,00,000 – Rs. 15,00,000 20%

More than Rs. 15,00,000 30%

income tax slab 2023-24

new income tax slab 2023-24

income tax slab rate for ay 2024-25

income tax slab

new slab of income tax 2023 24

new income tax slab

slab rates of income tax for ay 22-23

slab rates of income tax for ay 23-24

2023-24 income tax slab

income tax new slab

income tax new slab 2023-24

income tax slab rate for ay 2023-24

current income tax slab rate

latest income tax slab 2023 24

income tax slab for senior citizens for fy 2023 24

income tax new slab 2022 23

senior citizen income tax slab for ay 23-24

income tax slab for senior citizens ay 2022 23

slab rate of income tax ay 2023 24

old income tax slab

business income tax slab

income tax slab fy 2023-24

senior citizen income tax slab

fy 2023-24 income tax slab

Save Income Tax with Old Tax Regime FY-2023-24 |Income Tax Calculation| Deductions in old Tax Regime

• Income Tax Calculation| Save Income T...

If you want learn about What is GST, How to file GSTR-1.

Please click on given link below:-

GST Course #1 What is GSTR-1, GSTR-2, GSTR-3B,ITC In detail | GST basic to advance sikhe

PART-1 LINK:- • Free GST Complete Course in Hindi|Wha...

Tally Features in GST| GST basic to advance course

PART-2 LINK:- • GST basic to advance course Part-2|| ...

Create sales voucher with multiple Tax rate

PART-3 LINK:- • Tally Prime- Purchase Entry With GST ...

Create Sales Invoice with Multiple GST rate

PART-4 LINK:- • Part-4, Create Sales Invoice with Mul...

GSTR 1 Return Filing online-2023

PART-5 LINK • How to File GSTR 1| GSTR 1 Return Fil...

![[FREE] ЛИРИЧНЫЙ БИТ ДЛЯ РЭПА 2023 ФРИСТАЙЛ БИТ](https://images.mixrolikus.cc/video/RcuUVj1sTkU)

![[Doesn'tWork] ДОСТУП К BROFIST.IO 2 В 2020 ГОДУ?! | АБСОЛЮТНО БЕСПЛАТНО](https://images.mixrolikus.cc/video/uOMx5R8engg)