Bull Put Spread Strategy Explained | Vertical Spreads & Credit Spreads

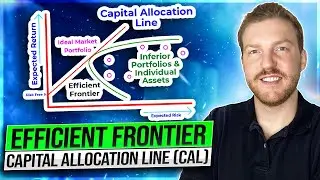

Dive deep into the Bull Put Spread Strategy, also known as the put credit spread, with Ryan O'Connell, CFA, FRM, in this comprehensive guide. Discover how this popular vertical spread technique can enhance your trading portfolio by learning the critical steps of selling a put with a higher strike price and buying a put with a lower strike price. This video breaks down each component of the Bull Put Spread, from basic put option definitions to the detailed analysis of profits and losses. Whether you're a beginner or an experienced trader, this tutorial will equip you with the knowledge to effectively implement and benefit from the Bull Put Spread Strategy in your trading activities.

🎓 This Video Is Part of My Full Options Trading Course:

Go deeper with step-by-step lessons, paper trading practice, and downloadable resources.

👉 https://ryano.finance/options-course

📈 See Why I Recommend This Broker For Options: https://ryano.finance/ibkr-options

📚 Get 25% Off CFA Courses (Featuring My Videos!) — Use code RYAN25 here:

✅ https://ryano.finance/cfa

Chapters:

0:00 - Intro to Bull Put Spreads Explained

0:35 - Put Option Definition

0:52 - Short Put Option Profits Explained

4:12 - Bull Put Spread Definition

5:00 - Step 1: Sell a Put W/ Higher Strike Price

5:29 - Step 2: Buy a Put W/ Lower Strike Price

6:34 - Bull Put Spread Profits & Losses

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.