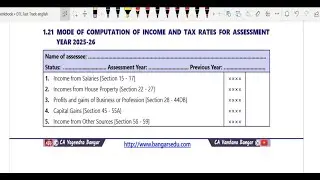

Mode of Computation of Total Income and General Rates of Income Tax for AY 2025-26

In this video detailed discussion have been made in respect of tax rates applicable in default tax regime under Section 115BAC and normal provisions of the Act. Concept of marginal relief and rebate under Section 87A has been discussed in detail.

![[FREE] LIL PEEP x LIL TRACY TYPE BEAT -](https://images.mixrolikus.cc/video/j3PaNyDOqUI)