Housing Market Update: Home Prices, Mortgage Rates, And Inventory Trends Explained

Q1 proved to bring about a lot of changes in the housing market. As we started to move out of the pandemic and based on the Fed decisions to taper their Bond and Treasury purchases as well as projections on inflation; we began to see rates rise.

The S&P CoreLogic Case-Shiller Indices are the leading measure of home prices throughout the country. The latest results show that in January 2022, home prices continued to increase nationwide. his report continues to show us that for those who own homes, equity is building at record speeds. For those who are yet to buy a home, or are in the process of looking, there is a cost of waiting which we will dive into now.

Cost of Waiting: As previously noted, based on the Fed decisions to taper their Bond/Treasury purchases and projections on inflation, we should expect to continue to see rates rise. However, rates are still expected to remain low from a historic perspective.

Rising interest rates combined with increasing home values can make a significant difference for those choosing to “wait out the market.”

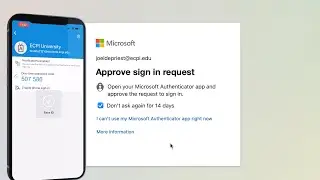

As discussed in our 2022 housing market forecast and mentioned above, rates are predicted to steadily increase throughout the year and that naturally impacts a client’s buying power. With inventory continuing to be incredibly limited, many properties seeing multiple offers, and interest rates continuing to rise, it is imperative that you make sure that at the time of offer that you can qualify what you are presenting in your offer.

Please know this is just a brief overview of things happening in today’s market. Feel free to drop your questions and comment below or visit our website www.fairwaymidatlantic.com and contact one of our loan officers today.

![Australian shepherd Woody - Sheepdog Training [ outrun, drive, split ]](https://images.mixrolikus.cc/video/VNRA_xCGu4I)