Dividend Stocks vs Vanguard Dividend ETF Portfolio | Vanguard VYM vs VIG | Vanguard Index Funds

MY EXACT Dividend Stock Portfolio -- See it in M1 Finance! ||

https://m1.finance/k8qmCoo7rDQu

Dividend Stocks vs Vanguard Dividend ETF Portfolio | How to Invest in the Stock Market

The stock market is absolutely crazy right now and the good news is, there are plenty of stocks that are on sale and ready to be bought at excellent prices. The big question is:

"Should I own individual Dividend Stocks or should I buy Dividend ETF's instead."

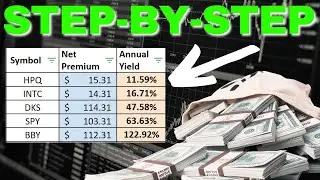

In this video I am talking about the important things/data to consider BEFORE you decide where to invest. Specifically, we are talking about Vanguard's High Dividend Yield ETF (VYM) and Vanguard's Dividend Appreciation ETF (VIG) in relation to an individual stock portfolio.

DIVIDEND YIELD

tHE DIVIDEND YIELD IS IMPORTANT AND IT REFLECTS HOW MUCH MONEY YOU ARE GETTING IN EXCHANGE FOR OWNING THE STOCK.

DIVIDEND GROWTH RATE

The dividend growth rate is most important as it reflects how much income is being generated from the investment we made.

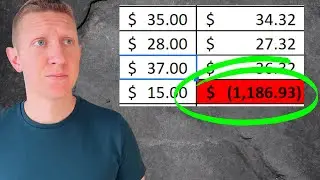

DIVIDEND PAYOUT RATIO

The dividend payout ratio is an important number to have and KNOW. Most people calculate the dividend payout ratio with dividends divided by net income but a better way to calculate it would be dividends divided by free cash flow.