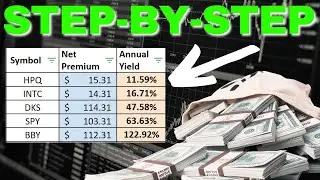

Quality Dividend Stocks to Buy THIS WEEK!

In this video we are talking about Dividend Stocks, specifically the dividend stocks that have upcoming ex-dividend dates this week that also have a dividend history of 5+ years raising their dividend every year.

----------------------------------------------------------------------------------------

JOIN THE PATREON COMMUNITY!

➡ / averagejoeinvestor

WANT ACCESS TO ALL OF MY SPREADSHEETS I USE ON THE CHANNEL ALONG WITH THE MONTHLY DIVIDEND STOCK SPREADSHEET AND INSTANT AWARENESS OF CHANGES TO MY PORTFOLIO? JOIN THE PATREON COMMUNITY!

----------------------------------------------------------------------------------------

➡ / averagejoeinvestor

You can also Work with Joe 1 ON 1!

Want to increase your option selling knowledge and get started!

----------------------------------------------------------------------------------------

🔴 Partner With Me - [email protected]

----------------------------------------------------------------------------------------

Need a GREAT Dividend Tracker for your portfolio? Here is what I use and it is EXCELLENT:

The Dividend Tracker: https://thedividendtracker.com/?ref=l...

----------------------------------------------------------------------------------------

This communication/content is for informational purposes only and is not intended as personalized investment advice, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon for purposes of transacting in securities or other investment vehicles.

----------------------------------------------------------------------------------------

Dividend stocks are shares in companies that distribute a portion of their earnings to shareholders in the form of dividends. These payments can be made quarterly, semi-annually, annually, or even monthly, depending on the company's policy.

Key Features of Dividend Stocks

Regular Income: Dividend stocks provide a steady stream of income, making them appealing to investors focused on passive income or retirement planning.

Stability: Companies that pay dividends are typically well-established with stable earnings. They often operate in industries like utilities, consumer staples, and finance, which are less volatile.

Growth Potential: Some dividend stocks increase their payouts over time, offering income growth alongside portfolio stability.

Types of Dividends

Cash Dividends: The most common type, paid directly into shareholders' accounts.

Stock Dividends: Payment in the form of additional shares.

Dividend Reinvestment Programs (DRIPs): Allow reinvestment of dividends into company stock.

Special Dividends: One-time payments distributed from accumulated profits.

Preferred Dividends: Fixed payouts for holders of preferred stock.

Dividend Funds: Mutual funds or ETFs that invest in dividend-paying stocks.

Benefits of Dividend Stocks

Portfolio Diversification: Dividend stocks can balance risk by adding stable income sources.

Inflation Hedge: Historically, companies that consistently increase dividends outperform during inflationary periods.

Passive Growth: Investors can reinvest dividends to compound returns over time.

Examples of High-Yield Dividend Stocks

Some top dividend stocks include:

International Seaways Inc (INSW) with a yield of 13.36%.

Two Harbors Investment Corp (TWO) at 13.01%.

Ready Capital Corp (RC) at 12.07%.

Additionally, reliable dividend-paying companies like Johnson & Johnson (JNJ), Coca-Cola (KO), and Procter & Gamble (PG) offer lower yields but consistent payouts.

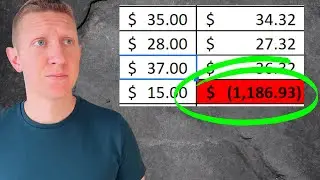

Considerations When Investing

While high yields may seem attractive, they can sometimes indicate unsustainable payouts or low stock prices. Investors should evaluate the company's financial health and dividend growth history before investing

A quality dividend stock is characterized by its ability to provide consistent and sustainable dividend payments, backed by strong financial and operational fundamentals. Here are the key attributes that define a quality dividend stock:

1. Financial Strength

Profitability: High return on equity (ROE) and stable earnings growth are indicators of a company's ability to generate profits and sustain dividend payouts.

Strong Cash Flow: Reliable free cash flow (FCF) ensures the company can cover dividends without jeopardizing operations or growth initiatives.

2. Dividend Stability and Growth

Consistent Payments: A history of regular and increasing dividends reflects a company’s commitment to shareholders and operational stability. Companies like Dividend Aristocrats (25+ years of increases) or Dividend Kings (50+ years) exemplify this trait.

Reasonable Payout Ratio: A payout ratio between 40% and 60% indicates a balance between rewarding shareholders and reinvesting in the business.