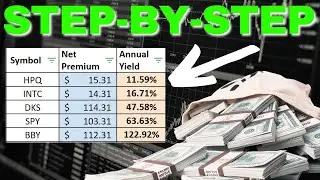

Are YieldMax ETF's in Trouble? Direct Competitor w/ BETTER Results?!

In this video we are talking about the Ultra High-Yield Income ETF's from Kurv which are very similar to the YieldMax ETF's but have different results. Kurv Income ETF's include AMZP NFLP AAPY GOOP MSFY AND TSLP. These income ETF's offer really high yields and MAY provide better capital erosion protection.

----------------------------------------------------------------------------------------

Get Access to the spreadsheet included in this video at this link:

----------------------------------------------------------------------------------------

JOIN THE PATREON COMMUNITY!

➡ / averagejoeinvestor

WANT ACCESS TO ALL OF MY SPREADSHEETS I USE ON THE CHANNEL ALONG WITH THE MONTHLY DIVIDEND STOCK SPREADSHEET AND INSTANT AWARENESS OF CHANGES TO MY PORTFOLIO? JOIN THE PATREON COMMUNITY!

-----------------------------------------------------------------------------------------

➡ / averagejoeinvestor

You can also Work with Joe 1 ON 1!

Want to increase your option selling knowledge and get started!

-----------------------------------------------------------------------------------------

🔴 Partner With Me - [email protected]

-----------------------------------------------------------------------------------------

Need a GREAT Dividend Tracker for your portfolio? Here is what I use and it is EXCELLENT:

The Dividend Tracker: https://thedividendtracker.com/?ref=l...

-----------------------------------------------------------------------------------------

This communication/content is for informational purposes only and is not intended as personalized investment advice, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon for purposes of transacting in securities or other investment vehicles.

------------------------------------------------------------------------------------------

The KURV Income ETF is part of Kurv Yield Premium Strategy ETFs, which aim to generate monthly income through a variety of sources including covered call option premiums, dividends, and interest income. Here's a detailed look based on available information:

Investment Strategy: KURV ETFs focus on a balance between income generation and capital appreciation. They use covered call strategies, which have been utilized since the 1980s by institutional and high-net-worth investors, to provide an income source. This involves writing call options to generate premium income while holding the underlying assets, thereby potentially mitigating some downside risk while limiting upside potential.

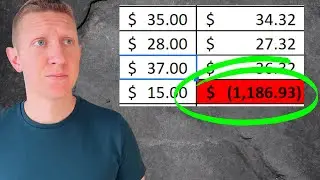

Performance: Past performance of these funds is not a guarantee of future results, but historically, they have aimed to provide current income alongside some exposure to the price movements of the underlying securities, like Alphabet Inc. for the Google (GOOGL) specific ETF. However, investment returns and principal value can fluctuate, meaning shares might be worth more or less than their original cost when redeemed.

Expense Ratios: The ETFs have both gross and net expense ratios, with a contractual agreement in place to cap fees not exceeding 0.99% of average daily net assets until December 31, 2024, subject to board approval.

Distribution Rate and SEC Yield: The distribution rate is an annualized figure based on the most recent fund distribution, which might include ordinary dividends, capital gains, or a return of capital. The 30-day SEC yield offers a standardized measure of a fund's income, calculated based on a formula mandated by the SEC.

User Feedback: Posts on X suggest that KURV ETFs have been viewed positively by some investors for income generation with limited NAV erosion, although there are concerns about low trading volume, which can affect liquidity and increase spreads. The lack of a dividend reinvestment plan (DRIP) for these ETFs has also been noted as a drawback for some investors.

Management and Availability: Kurv ETFs are managed by professionals with significant experience from major firms like PIMCO, Goldman Sachs, and JP Morgan. These ETFs are available for purchase through most online brokerages or U.S. stock exchanges.

When considering investing in KURV Income ETF or any similar product, it's crucial to understand the strategies involved, particularly the implications of covered call writing on potential gains and losses, and to consider personal investment goals, risk tolerance, and market conditions. Always review the fund's prospectus for detailed information on risks, fees, and investment strategies.